Bookkeeping

Services

Our Bookkeeping Blog Posts

Simple Bookkeeping Strategies to Save on Taxes

Keeping your business finances organized isn’t just about understanding your numbers—it’s also one of the smartest ways to legally save money on taxes without the stress.

In this post, we’ll walk you through a few simple bookkeeping strategies that can help you track expenses, maximize deductions, and be better prepared when tax season arrives.

1. Record every income and expense from day one

It may seem obvious, but many entrepreneurs only start tracking their finances when tax deadlines approach. The truth is, forgetting to record a business expense means missing out on a deduction. Use an app, spreadsheet, or hire a bookkeeping service to log your activity consistently.

What isn’t recorded can’t be deducted.

2. Separate personal and business accounts

One of the most common and costly mistakes is mixing personal and business finances. Opening a dedicated business account gives you clearer records and better visibility—and it’s much easier to spot deductible expenses.

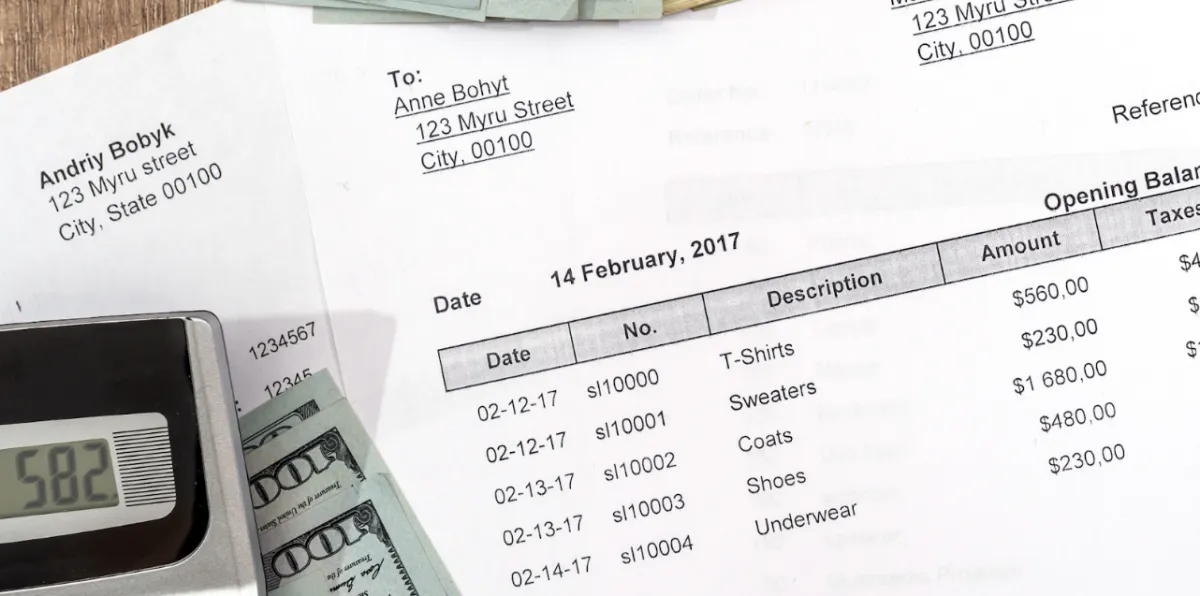

3. Categorize your expenses correctly

Not all expenses are created equal. Some are fully deductible, others are partial, and some not at all. Make sure your bookkeeping system allows you to tag your expenses by category: contractor payments, software, travel, marketing, office supplies, etc.

Smart categorization reduces errors and increases legal tax savings.

4. Use monthly financial reports (like P&L)

Your Profit & Loss (P&L) report gives you a clear snapshot of how much you're actually earning after expenses. Reviewing it monthly helps you stay on track, make financial adjustments early, and ease the stress of tax prep.

5. Work with a professional (before it’s too late)

Bookkeeping isn't just for big companies. At SF Solutions, we support freelancers, entrepreneurs, and small businesses with organized, compliant, and stress-free financial management.

Delegating your bookkeeping is an investment in clarity, peace of mind, and long-term savings.

Ready to get started?

If you're already applying some of these strategies—great! If not, now is the perfect time to start. At SF Solutions, we offer:

✔️ Income and expense tracking

✔️ Monthly financial reports (P&L)

✔️ Review of tax deduction opportunities

✔️ Personalized, human-centered guidance

📲 Schedule your free consultation and discover how bookkeeping can help you save more than you imagined.

SF Solutions – Bookkeeping with a human touch.

Discover Efficient Bookkeeping Solutions

Bookkeeping Services

At SF Solutions, we simplify your financial management with our professional bookkeeping services.

Partnering with APROFI, the bookkeeping expert firm, we handle the meticulous recording and organization of all your financial transactions, ensuring accuracy and clarity in your records.

Why bookkeeping matters?

It's the foundation of smart financial decisions and tax strategies.

By keeping your finances organized, you gain insights into your business's performance and can make informed decisions for growth and deductions.Let us take care of your bookkeeping needs, so you can focus on what you do best—running your business.

Call Us Now

469-405-7054