Bookkeeping

Services

Our Bookkeeping Blog Posts

The 3 Pillars of a Successful Insurance Agent

Many insurance agents focus on selling, getting new clients, or renewing certifications. But what truly sets apart agents who grow consistently and sustainably is their work structure. Having an organized system isn’t a luxury — it’s a strategy.

In this post, we’ll show you the key elements every agent needs to build a strong foundation that supports growth, clarity, and peace of mind.

1. What is an organizational structure for an insurance agent?

It’s the combination of processes, tools, routines, and systems that bring order to your daily operations. From how you follow up with clients to how you record income and commissions — a good structure helps you make better decisions, save time, and scale without chaos.

2. The 3 Pillars of a Strong Agent Structure

A. Clear Processes

Defined processes reduce guesswork. For example:

Sales process: from lead to close

Follow-up process: reminders, messages, renewals

Post-sale process: support, updates, referrals

B. Organized Tools

Having tools isn’t enough — you need to use them well. A well-set-up CRM, accurate financial reports, and monthly commission reconciliation can transform your efficiency. All tools should fit your workflow.

C. Well-Managed Time

Many agents operate in crisis mode. Urgent tasks take over and important ones get pushed aside. A structured calendar ensures you make time to sell, serve clients, and review your operations.

3. Direct Benefits of a Solid Structure

Less stress, more focus

Better client experience

Reliable data to make decisions

More time for prospecting and closing sales

4. How We Can Help

At SF Solutions, we help insurance agents build a structure that fits their business. From CRM setup to bookkeeping, reporting, and commission tracking — we can start with just one part or manage the entire back office for you.

Your structure isn’t something you set up “when there’s time.” It’s the foundation that allows you to grow, stay focused, and stay in control. Start now — your business needs it.

✉️ Message us for a free consultation.

Discover Efficient Bookkeeping Solutions

Bookkeeping Services

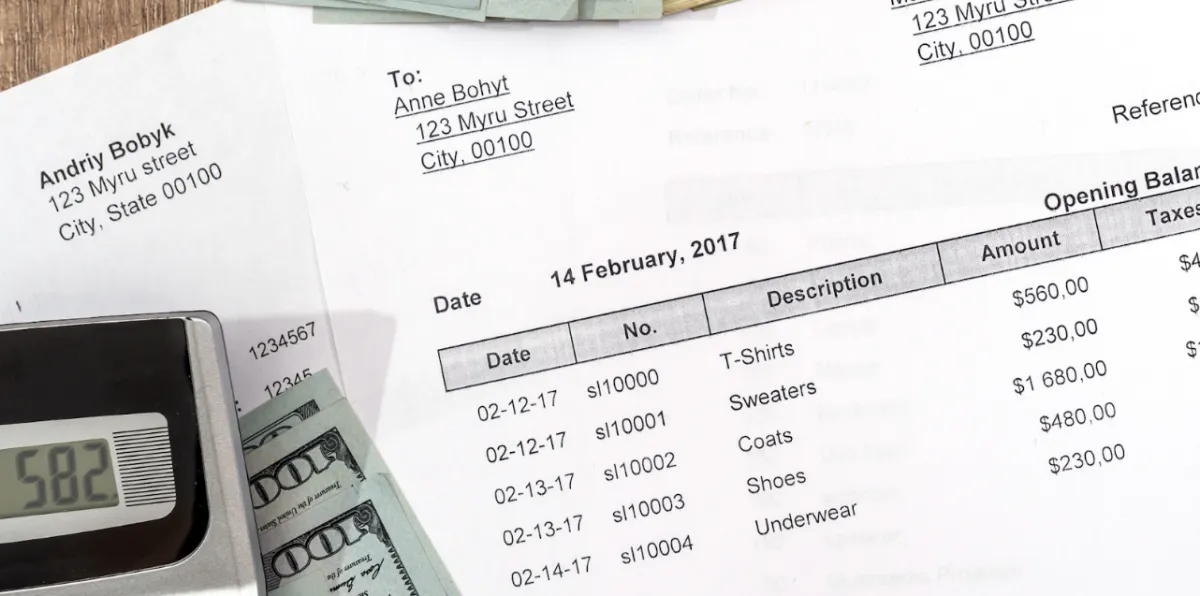

At SF Solutions, we simplify your financial management with our professional bookkeeping services.

Partnering with APROFI, the bookkeeping expert firm, we handle the meticulous recording and organization of all your financial transactions, ensuring accuracy and clarity in your records.

Why bookkeeping matters?

It's the foundation of smart financial decisions and tax strategies.

By keeping your finances organized, you gain insights into your business's performance and can make informed decisions for growth and deductions.Let us take care of your bookkeeping needs, so you can focus on what you do best—running your business.

Call Us Now

469-405-7054