Bookkeeping

Services

Our Bookkeeping Blog Posts

Medicare Economic Benefits: How to Save on Healthcare and Prescription Drugs

The healthcare system in the United States can be expensive, especially for older adults or people with chronic medical conditions. However, Medicare offers economic benefits that help significantly reduce medical expenses.

In this article, you’ll discover how Medicare works, which coverages include major savings, and real-life examples of how you can benefit financially.

What is Medicare and why does it represent savings?

Medicare is the federal health insurance program designed for people aged 65 and older, as well as for some individuals with disabilities.

Its greatest advantage is that it lowers the cost of medical care, preventing beneficiaries from facing excessive expenses for hospital stays, doctor visits, or medications.

Main parts of Medicare

Part A (Hospital Insurance): Covers inpatient hospital stays, care in skilled nursing facilities, and hospice services.

Part B (Medical Insurance): Includes doctor visits, outpatient services, and medical supplies.

Part C (Medicare Advantage): Private plans that combine Parts A and B, with extra benefits such as vision, dental, and hearing.

Part D (Prescription Drugs): Helps reduce the cost of medications.

Economic benefits of Medicare

Medicare not only protects your health but also your wallet. Here are some of the most relevant savings:

Low-cost hospitalization

A single day in a private hospital can cost between $2,000 and $5,000. With Medicare Part A, beneficiaries pay only a fixed deductible per benefit period, significantly reducing the financial burden.

More affordable medications

With Part D, prescription drugs can cost up to 70% less compared to paying out of pocket. In addition, every year there are discount programs and extra coverage for commonly used medications.

Free or low-cost preventive care

Medicare covers many preventive screenings at no additional cost, such as:

Flu shots

Mammograms

Cholesterol tests

This means fewer expenses for costly treatments in the long run.

Extra services with Medicare Advantage

Some Medicare Advantage (Part C) plans include coverage for:

Glasses and eye exams

Hearing aids

Dental treatments

These services represent major savings since they are usually quite expensive when paid for privately.

Real-life examples of savings with Medicare

To better understand the economic impact, let’s look at a few examples:

Example 1: Maria, 67 years old

Before Medicare, Maria paid $350 per month for blood pressure medications. With Part D, her cost dropped to $45 a month, saving more than $3,600 per year.Example 2: Robert, 72 years old

After knee surgery, the hospital bill totaled over $25,000. Thanks to Medicare Part A, Robert only paid the deductible of $1,632 (2024), saving more than $23,000.Example 3: Carmen, 70 years old

Carmen needed a hearing aid, which cost $2,500 on the market. Her Medicare Advantage plan covered most of it, and she paid only $800.

Strategies to maximize Medicare savings

Compare plans every year

Costs and coverage change annually. Reviewing and comparing plans can help you find the most affordable option.

Use in-network pharmacies

Some pharmacies offer additional discounts for Medicare members, which means even greater savings.

Take advantage of preventive benefits

Covered checkups and vaccines can help prevent medical complications that would lead to large bills in the future.

Long-term economic benefits

Medicare not only reduces immediate expenses but also provides long-term financial protection:

Less medical debt.

Access to quality healthcare without sacrificing personal savings.

Greater financial peace of mind for retirees and families.

The economic benefits of Medicare are clear: reduced costs for hospitalization, medications, doctor visits, and additional services.

By understanding how each part of the program works and choosing the right plan, beneficiaries can save thousands of dollars each year and enjoy a better quality of life.

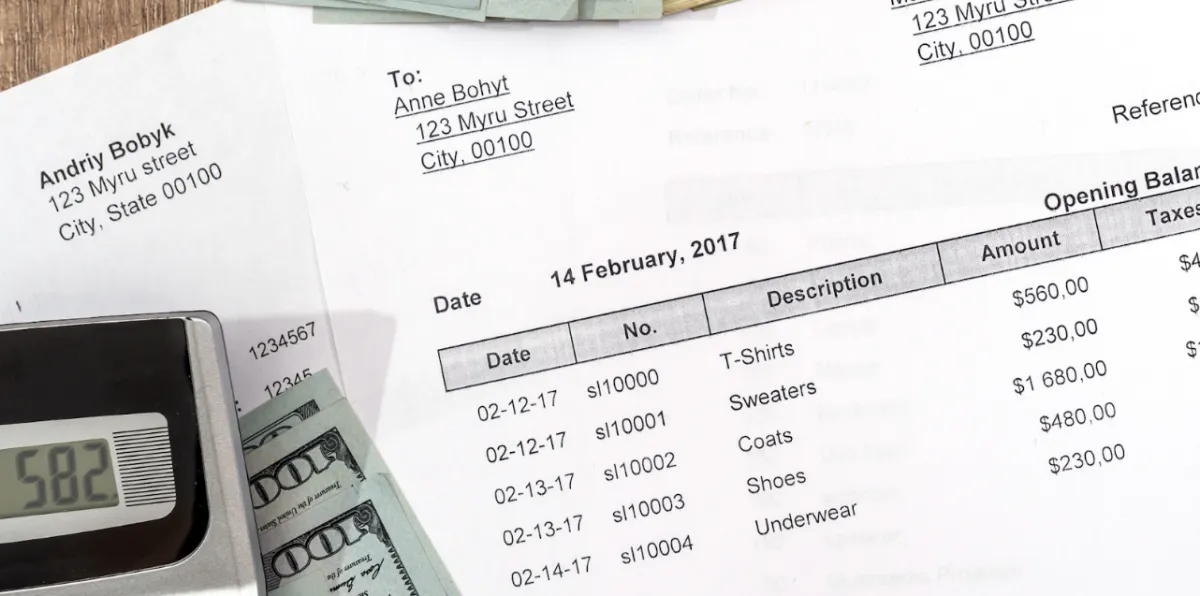

Discover Efficient Bookkeeping Solutions

Bookkeeping Services

At SF Solutions, we simplify your financial management with our professional bookkeeping services.

Partnering with APROFI, the bookkeeping expert firm, we handle the meticulous recording and organization of all your financial transactions, ensuring accuracy and clarity in your records.

Why bookkeeping matters?

It's the foundation of smart financial decisions and tax strategies.

By keeping your finances organized, you gain insights into your business's performance and can make informed decisions for growth and deductions.Let us take care of your bookkeeping needs, so you can focus on what you do best—running your business.

Call Us Now

469-405-7054